Navigating Bank-Owned Homes: What Aspiring Property Buyers Need to Know

Understanding Bank-Owned Homes: An Overview

Bank-owned homes, also known as Real Estate Owned (REO) properties, are properties that have reverted to the financial institution after an unsuccessful foreclosure auction. In the process of foreclosure, if a home does not sell at auction, the bank becomes the owner. This situation presents a unique opportunity for property buyers, as these homes are often priced below market value to expedite their sale. However, purchasing such a property requires a thorough understanding of the potential risks and rewards involved.

One of the primary advantages of investing in bank-owned homes is the potential for acquiring a property at a reduced price. Since banks are not in the business of holding onto real estate, they are typically eager to sell these properties quickly. This can sometimes lead to attractive pricing for buyers. However, it’s essential to remember that the condition of these homes can vary significantly. Some may require extensive repairs, while others might be in good shape.

For aspiring buyers, it is crucial to conduct a comprehensive assessment of each property. This includes evaluating the location, the overall condition of the home, and any additional fees that might be associated with the purchase. Understanding these factors will help buyers make informed decisions and potentially secure a property that meets their needs and budget.

The Buying Process: Steps to Consider

The process of purchasing a bank-owned home differs from a traditional home purchase and involves several critical steps. First, potential buyers should start by searching for REO properties through real estate listings, bank websites, or by contacting real estate agents specializing in foreclosures. Once a property of interest is identified, it’s important to conduct a detailed inspection to assess its condition and any repairs needed.

Next, buyers should secure financing. Although these homes are often priced attractively, securing a mortgage can sometimes be more challenging due to the property’s condition. Lenders may require a higher down payment or specific loan types tailored for fixer-upper properties. It’s advisable to work with a lender experienced in foreclosures to navigate these potential hurdles.

Once financing is in place, buyers should submit an offer. It’s worth noting that banks may take longer to respond to offers compared to individual sellers. Patience is key during this stage. If the offer is accepted, the buyer will enter into a contract and proceed with closing the deal. Throughout the process, having a knowledgeable real estate agent or attorney can be invaluable, ensuring all legal and procedural aspects are handled correctly.

Evaluating Property Condition: What to Look For

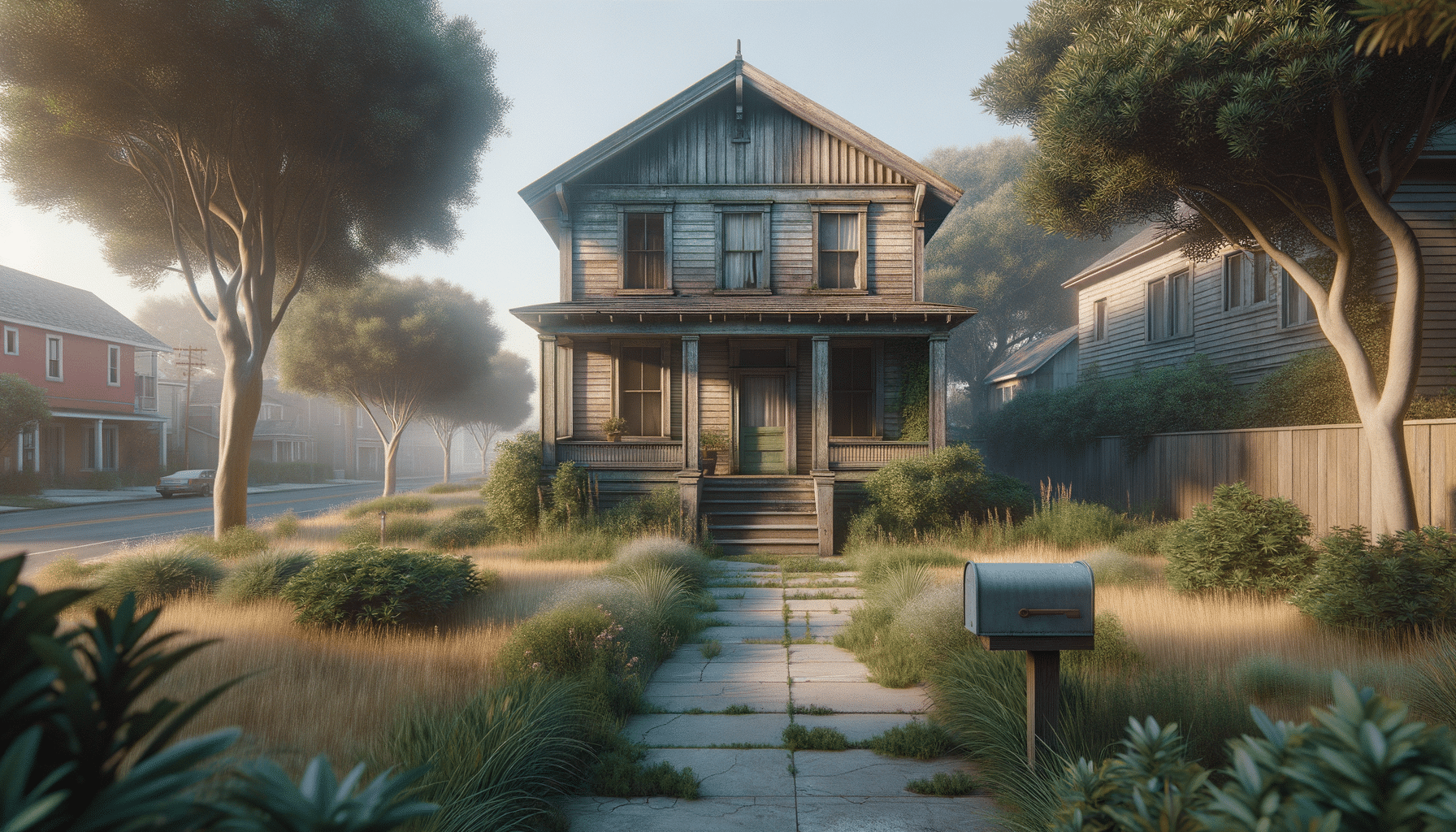

When considering a bank-owned home, it’s crucial to thoroughly evaluate the property’s condition. These homes are sold “as-is,” meaning the bank will not make repairs before the sale. Therefore, buyers must be vigilant in identifying potential issues that could affect the property’s value or require costly repairs.

Start by inspecting the exterior for signs of neglect, such as peeling paint, damaged roofing, or overgrown landscaping. Inside, check for structural issues, like cracks in the walls or ceilings, and assess the condition of essential systems, including plumbing, electrical, and HVAC. It’s also wise to look for signs of water damage or mold, as these can indicate more significant underlying problems.

Hiring a professional home inspector is highly recommended. An inspector can provide a detailed report on the property’s condition, highlighting areas that need attention. This information can be crucial for negotiating the purchase price or deciding whether the investment is worthwhile. Understanding the full scope of potential repairs will help buyers budget accordingly and avoid unexpected expenses.

Financial Considerations: Costs Beyond the Purchase Price

While bank-owned homes can offer financial advantages, it’s important for buyers to be aware of costs beyond the purchase price. These additional expenses can impact the overall investment and should be factored into the decision-making process.

First, consider the cost of repairs and renovations. As mentioned earlier, many bank-owned properties require some level of work, ranging from minor cosmetic updates to major structural repairs. Buyers should obtain quotes for necessary repairs before finalizing the purchase to ensure they are financially prepared.

Additionally, there are closing costs to consider, which can include fees for title insurance, escrow services, and property taxes. Buyers should also budget for potential legal fees if they choose to hire an attorney for assistance with the transaction.

Another financial aspect to consider is the potential for higher insurance premiums. Some insurers may charge more for bank-owned homes due to perceived risks associated with their condition. It’s advisable to shop around for insurance quotes to find the best coverage at a reasonable price.

Conclusion: Making an Informed Decision

Purchasing a bank-owned home can be a rewarding venture for aspiring property buyers, offering the chance to acquire real estate at a potentially lower cost. However, it’s essential to approach the process with a clear understanding of the unique challenges and considerations involved. By thoroughly evaluating the property’s condition, understanding the financial implications, and navigating the buying process with care, buyers can make informed decisions that align with their goals and budget.

Ultimately, while bank-owned homes present opportunities, they also require careful planning and due diligence. With the right approach and resources, buyers can successfully navigate the complexities of acquiring these properties and potentially secure a home that not only meets their needs but also represents a sound investment.